In today’s global economy, distributors play a critical role in keeping supply chains moving. But when tariffs are introduced or increased (you may have read a few headlines over the past month or so regarding tariffs) it can throw even the most organized operations off balance. Whether you’re importing goods directly or your suppliers are, tariffs can have a ripple effect on your bottom line, especially when it comes to cash flow and working capital.

The Cash Flow Crunch from Tariffs

Tariffs raise the cost of imported goods. That’s the part most people understand. But for distributors, the impact doesn’t stop there. You’re often required to pay these additional costs upfront, long before the product is sold and the revenue is collected. This can significantly strain your cash flow.

If you’re not prepared, this disruption can affect your ability to pay vendors, meet payroll, or even take advantage of growth opportunities. And when cash flow tightens, working capital suffers too, creating a domino effect that can slow down your entire operation.

Distributors in Port Cities Feel It First

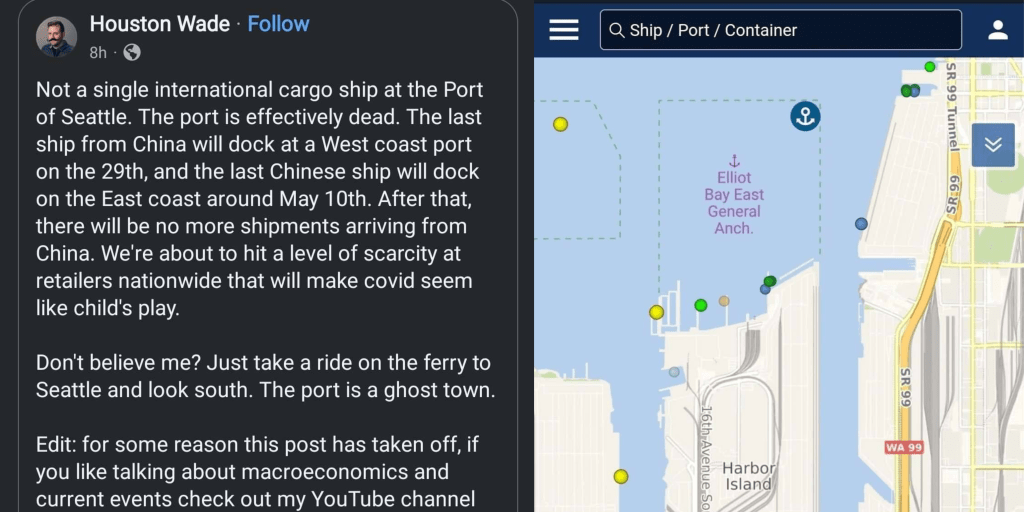

Distributors located near major port cities are feeling the effects of tariffs more acutely and more quickly than others. Areas like Savannah, GA, and with its bustling shipping terminals and heavy import activity, are seeing immediate cost increases as goods land and tariffs are assessed. These hubs often act as the first stop for international cargo, meaning distributors there are hit with tariff-related expenses earlier in the supply chain, often before they’ve had a chance to pass costs along or collect payment from customers.

This is Seattle, WA:

The Role of a Good Bookkeeper

In these situations, having a knowledgeable bookkeeper on your side is more important than ever. A bookkeeper can help you keep track of every dollar: what’s coming in, what’s going out, and how much you need to reserve for upcoming obligations like tariff payments.

They can also help forecast cash flow based on projected costs and revenues, giving you the clarity you need to make smart decisions in real time. It’s not just about staying afloat, it’s about staying ahead.

Accelerate Cash Flow with Invoice Factoring

One powerful tool more distributors are turning to is invoice factoring. Rather than waiting 30, 60, or even 90 days for customers to pay, factoring allows you to get cash in hand now by selling your receivables to a factoring company.

This immediate access to capital can help cover the increased costs caused by tariffs without having to dip into reserves or delay other expenses. Think of it as a way to reclaim control of your cash flow—and maintain momentum even in uncertain times.

Let’s Talk

Navigating tariffs and their financial implications isn’t easy, but you don’t have to do it alone. At Windsor Solutions, we specialize in helping distributors manage cash flow challenges with smart bookkeeping and invoice factoring strategies. We are based in Savannah, GA but we work with distributors across the United States.

Schedule a free consultation with us today to discuss how we can support your business—before the next round of tariffs hits your ledger.